Rates, Terms and Licensing Information

Please select your state of legal residence to see the rates and terms that apply to you.

The rates and terms of available loans are tailored to your situation, and they may vary by program.

The specific loan amount, APR, and terms you may qualify for depend on your credit and loan repayment history, employment history, and other factors.

We do not currently have a loan product available in Nebraska.

Installment loans for residents of

$500.00 - $15,000.00

36.00% - 179.50%

12, 18, 24, 36 or 48 months

5% of loan amount *We charge this at the time we approve your loan and you e-sign your loan agreement. We add it to the amount that you receive instead of subtracting it, so you have use of the full amount that you asked to borrow. It's a one-time fee you pay for over time as part of your scheduled loan payments. Excludes loans funded to merchants.

Origination fee of 5% of loan amount may be charged to your loan.

Loans offered in your state are made by First Electronic Bank, a Utah-chartered industrial bank located in Salt Lake City, Utah. Personify works with First Electronic Bank to originate installment loans made by First Electronic Bank using the Personify Platform. Residents of this state can qualify for a Rate Reduction program. Those seeking a loan, and who are eligible for this program, will be provided more detail on the Offer Page.

The rates and terms of available loans are tailored to your situation, and they may vary by program.

The specific loan amount, APR, and terms you may qualify for depend on your credit and loan repayment history, employment history, and other factors.

Payment example with Origination Fee and with Rate Reduction Program: For a $3,500.00, 36-month loan, with an APR of 59.00%, an origination fee that will be included in the principal amount of your loan (5% of the amount you receive) of $175.00, and a monthly payment schedule, you would make 6 payments of $211.29, 6 payments of $207.23, 6 payments of $203.80, 6 payments of $201.10, 6 payments of $199.17, and 6 payments of $198.10, repaying a total of $7,324.14 over the life of the loan with a finance charge of $3,824.14.

Installment loans for residents of

$500.00 - $15,000.00

36.00% - 179.50%

12, 18, 24, 36 or 48 months

5% of the financed amount or $175, whichever is lower. *We charge this at the time we approve your loan and you e-sign your loan agreement. We add it to the amount that you receive instead of subtracting it, so you have use of the full amount that you asked to borrow. It's a one-time fee you pay for over time as part of your scheduled loan payments. Excludes loans funded to merchants.

Origination fee of 5% of the financed amount or $175, whichever is lower, may be charged to your loan.

Loans offered in your state are made by First Electronic Bank, a Utah-chartered industrial bank located in Salt Lake City, Utah. Personify works with First Electronic Bank to originate installment loans made by First Electronic Bank using the Personify Platform. Residents of this state can qualify for a Rate Reduction program. Those seeking a loan, and who are eligible for this program, will be provided more detail on the Offer Page.

The rates and terms of available loans are tailored to your situation, and they may vary by program.

The specific loan amount, APR, and terms you may qualify for depend on your credit and loan repayment history, employment history, and other factors.

Payment example with Origination Fee and with Rate Reduction Program: For a $3,500.00, 36-month loan, with an APR of 59.00%, an origination fee that will be included in the principal amount of your loan (5% of the amount you receive) of $175.00, and a monthly payment schedule, you would make 6 payments of $211.29, 6 payments of $207.23, 6 payments of $203.80, 6 payments of $201.10, 6 payments of $199.17, and 6 payments of $198.10, repaying a total of $7,324.14 over the life of the loan with a finance charge of $3,824.14.

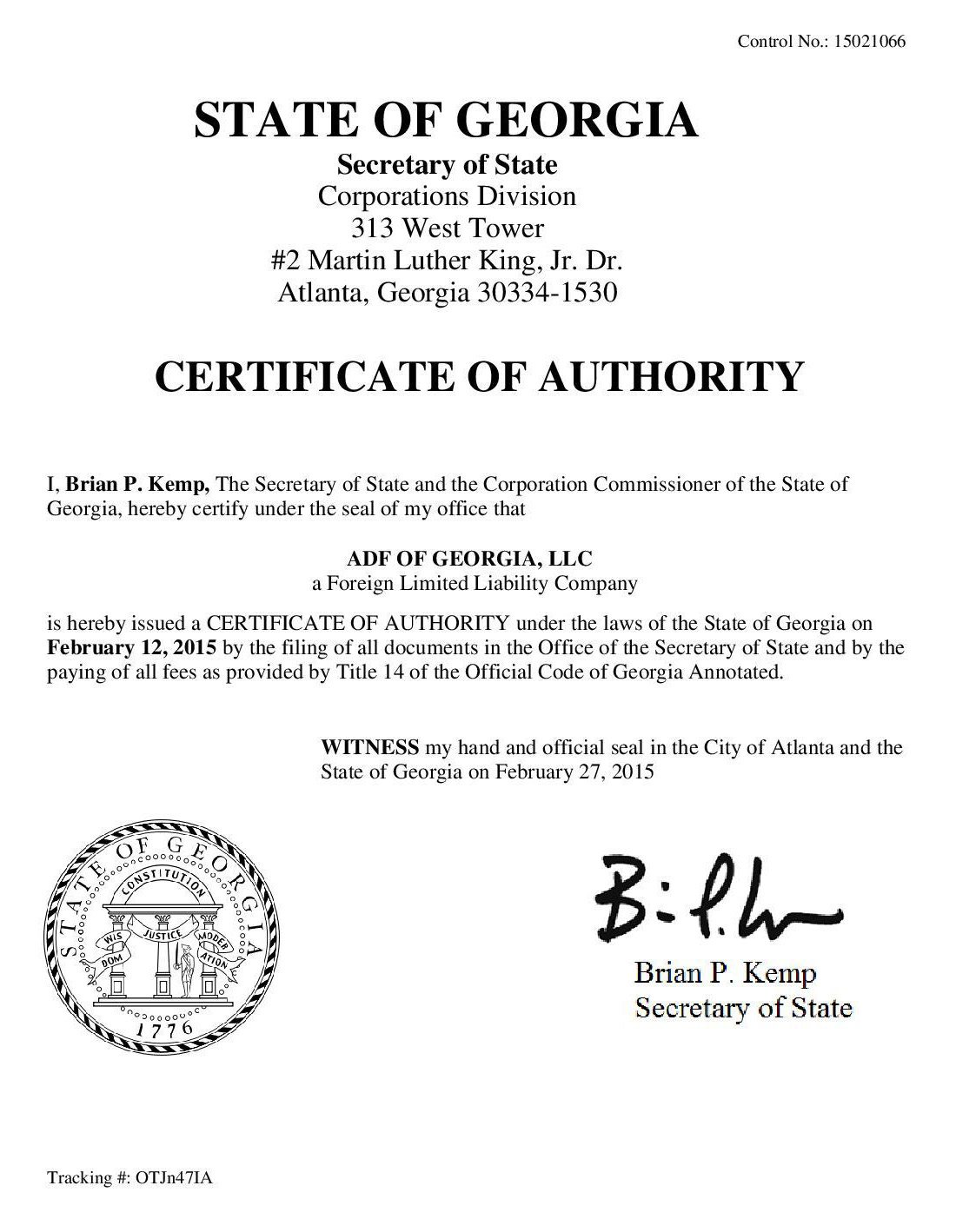

Installment loans for residents of Georgia

The rates and terms of available loans are tailored to your situation, and they may vary by program.

The specific loan amount, APR, and terms you may qualify for depend on your credit and loan repayment history, employment history, and other factors.

Example 2: For a $4,300, 36-month loan, with an APR of 59.04%, and a monthly payment schedule, you would make 36 payments of $257.21, repaying a total of $9,259.56 over the life of the loan with a finance charge of $4,959.56.

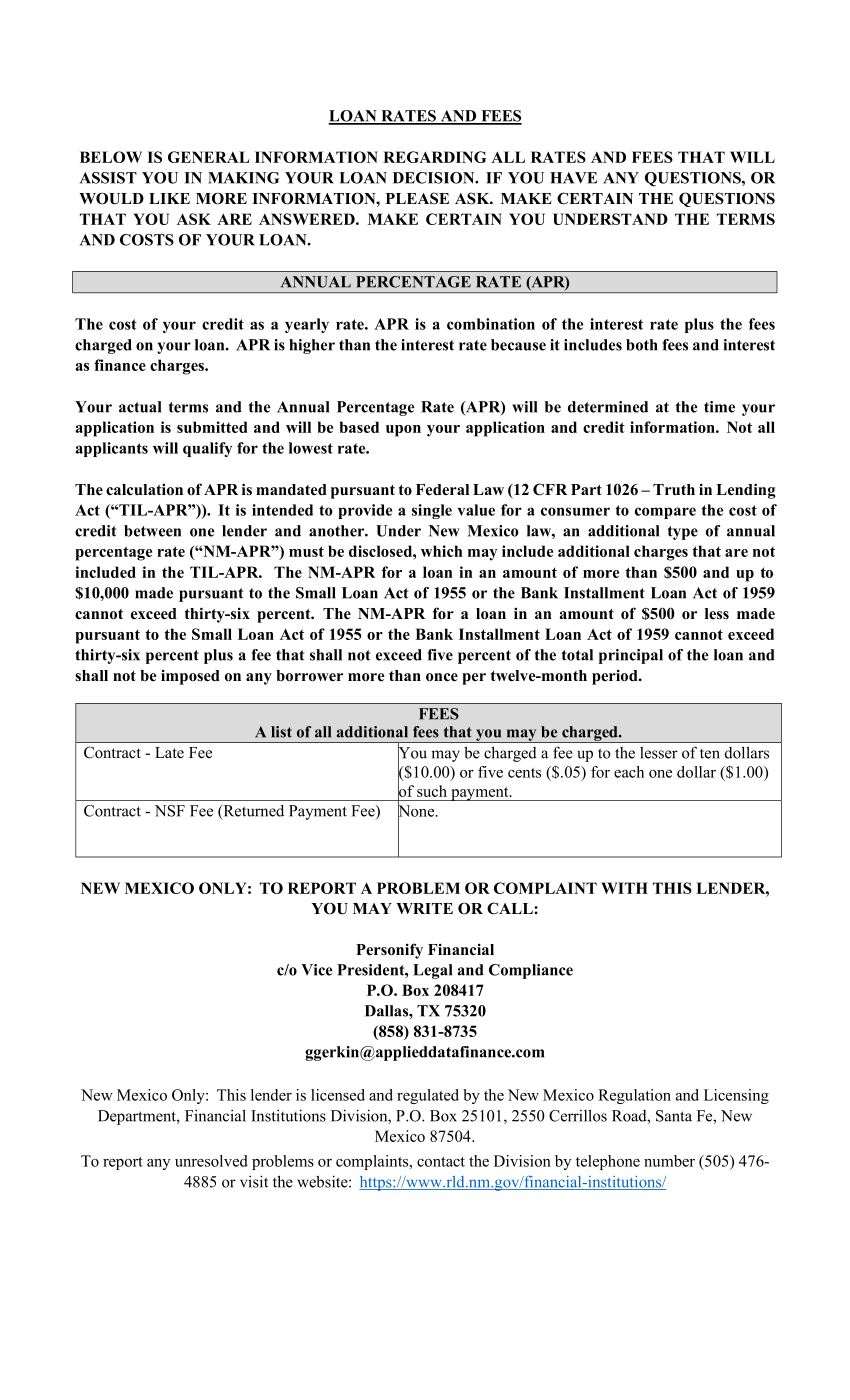

We no longer offer any loan products in New Mexico. The material presented here is for informational purposes only.

TO REPORT A PROBLEM OR COMPLAINT WITH THIS LENDER, YOU MAY WRITE OR CALL

Personify Complaints

PO Box 208417

Dallas, TX 75320-8417

Telephone: 866-578-9546

Email: (Complete the CAPTCHA to reveal the Personify Complaints email)

Email: complaints@personifyfinancial.com

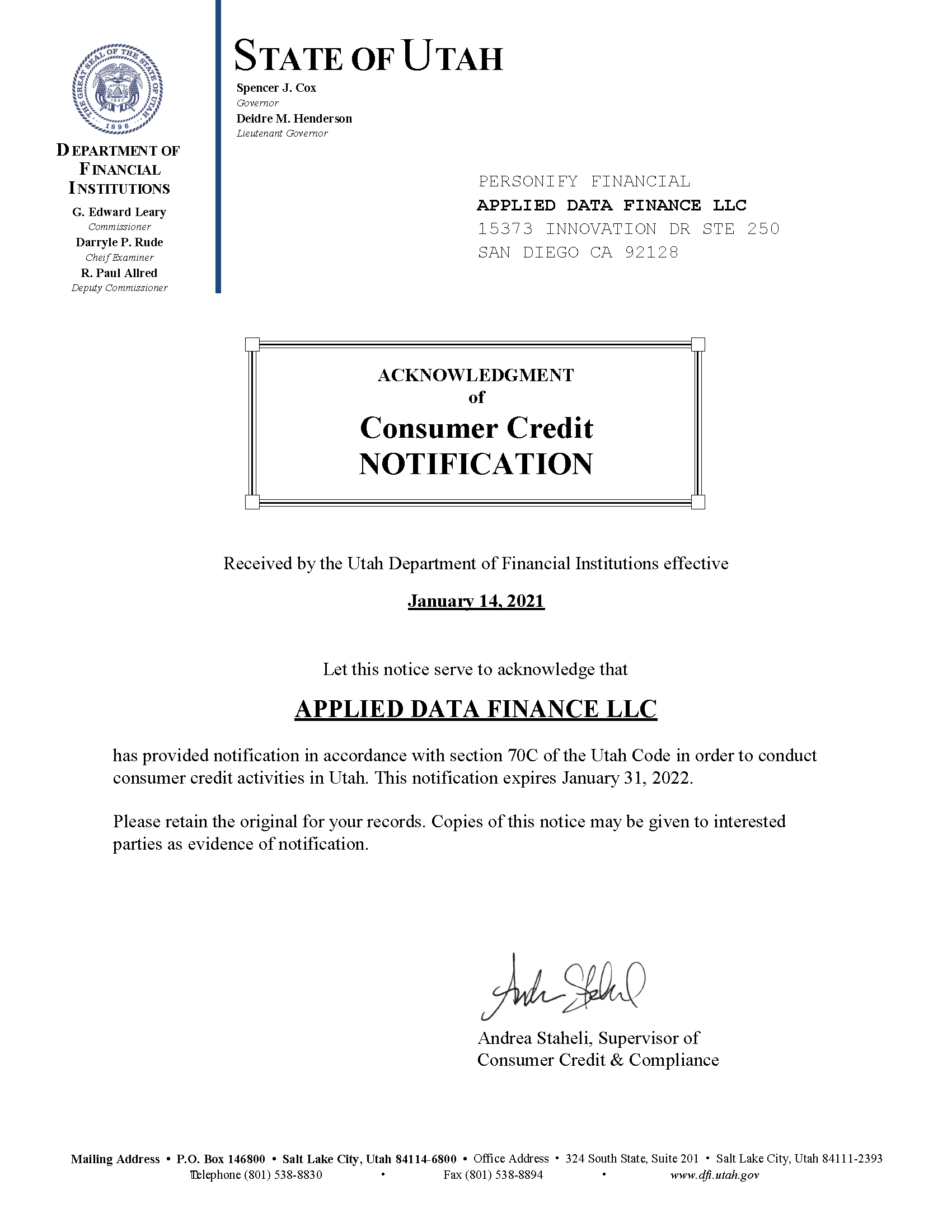

The rates and terms of available loans are tailored to your situation, and they may vary by program. The specific loan amount, APR, and terms you may qualify for depend on your credit and loan repayment history, employment history, and other factors. Loans offered in your state are offered by Personify Financial or First Electronic Bank, a Utah chartered industrial bank located in Salt Lake City, Utah.

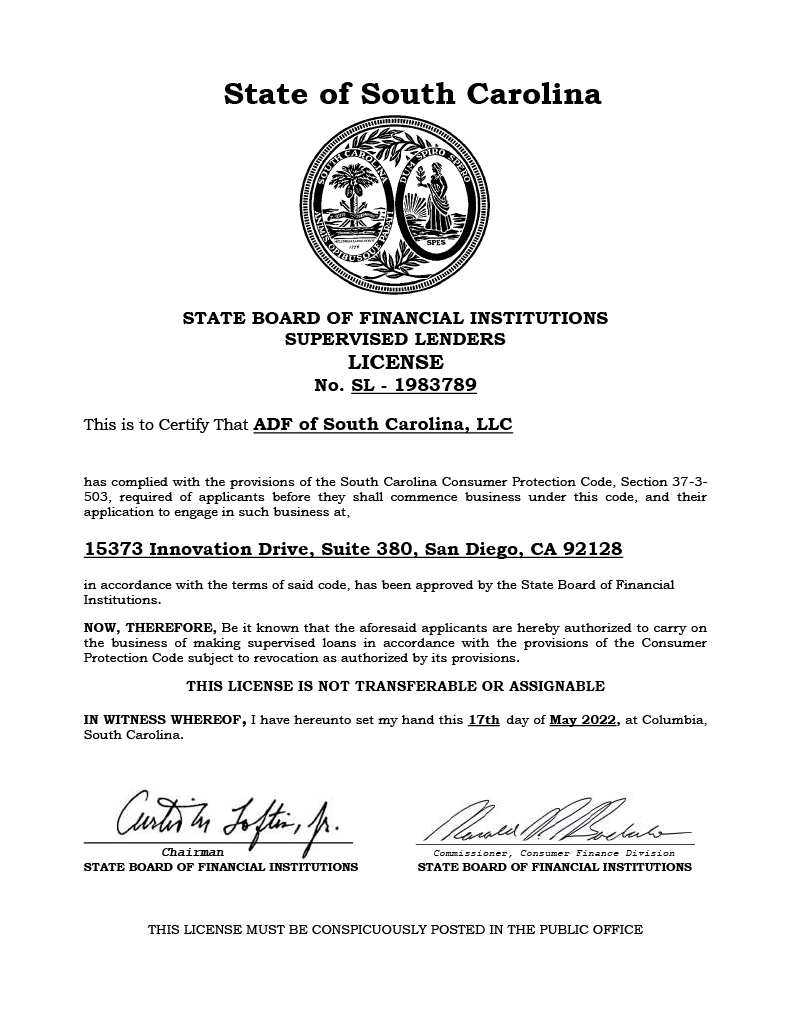

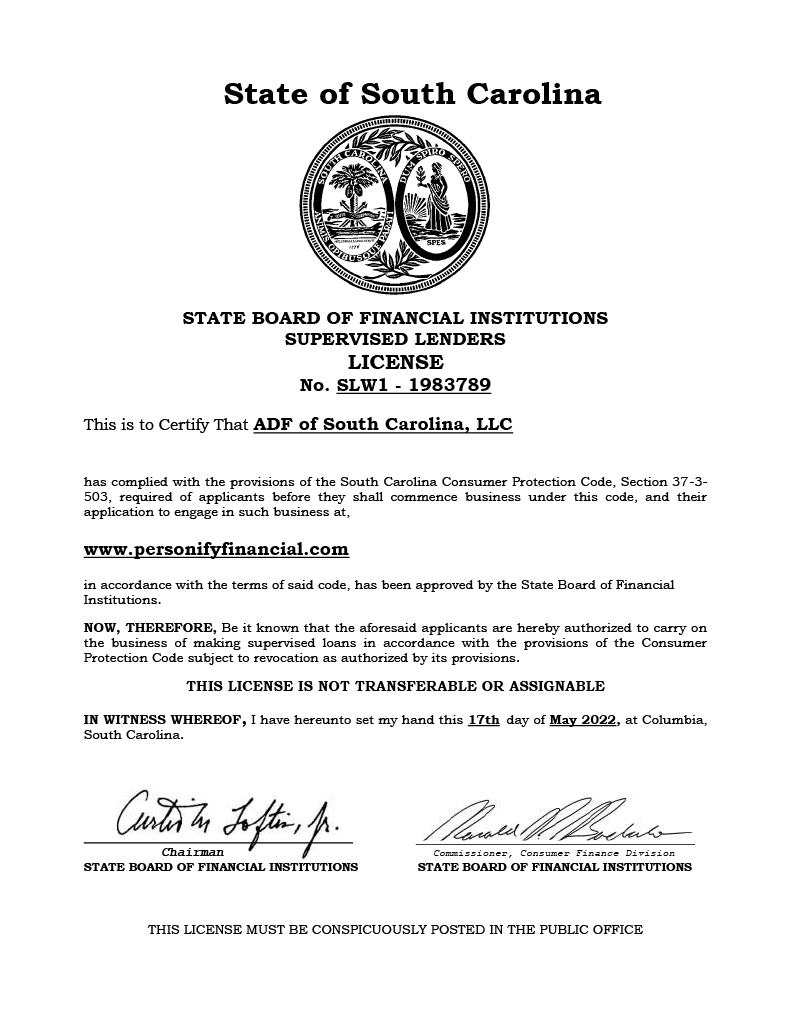

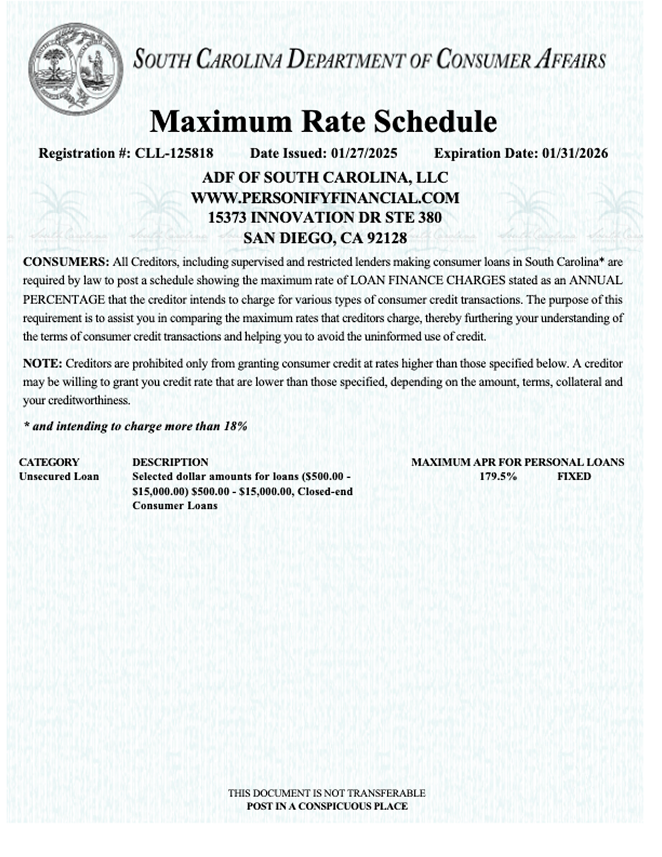

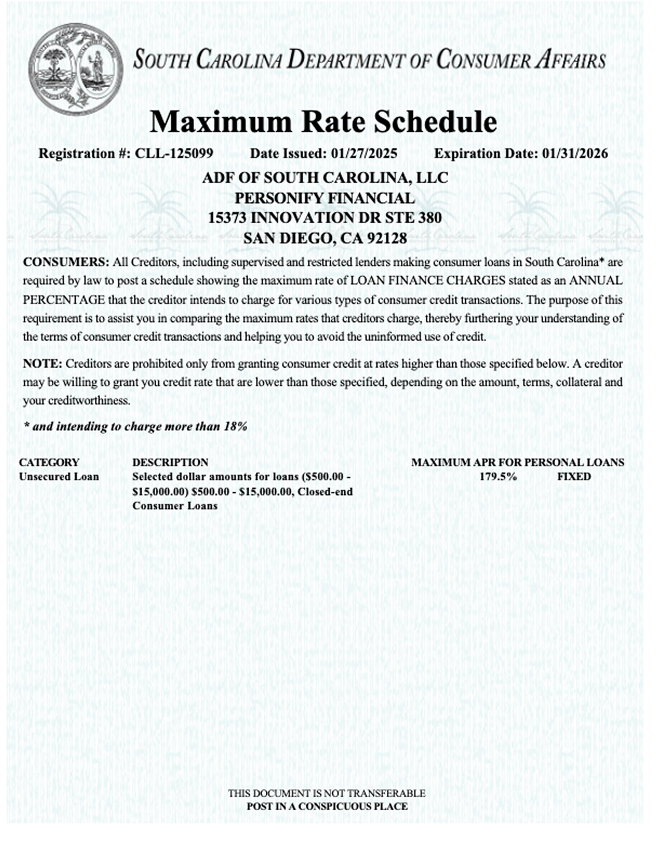

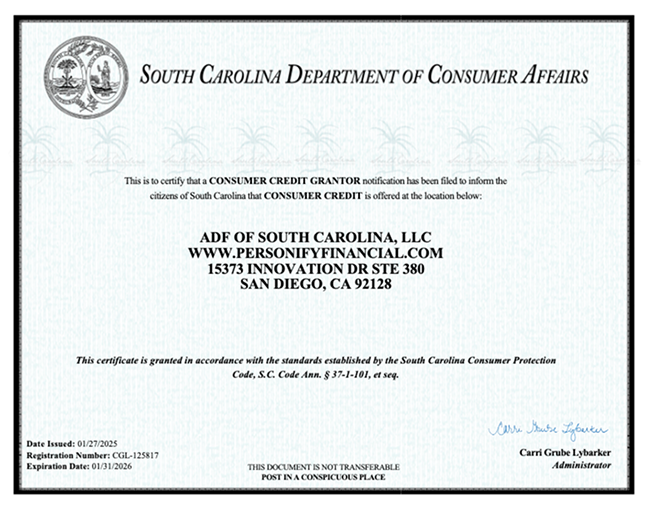

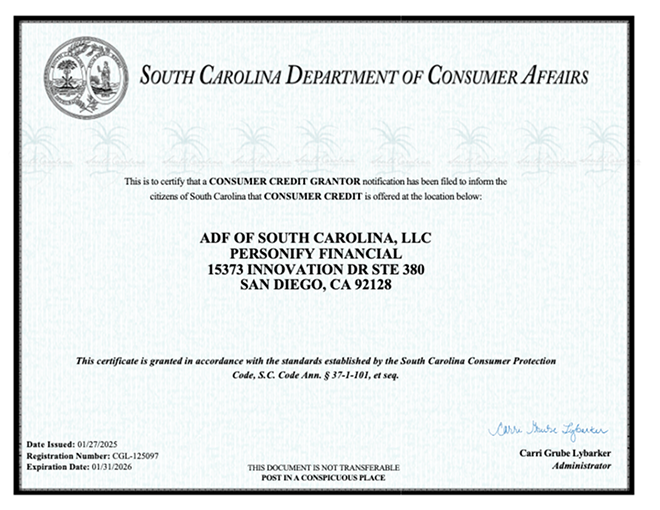

First Electronic Bank installment loans for residents of South Carolina

$500.00 - $15,000.00

36.00% - 179.50%

12, 18, 24, 36 or 48 months

5% of loan amount

*We charge this at the time we approve your loan and you e-sign your loan agreement. We add it to the amount that you receive instead of subtracting it, so you have use of the full amount that you asked to borrow. It's a one-time fee you pay for over time as part of your scheduled loan payments. Excludes loans funded to merchants.

Origination fee of 5% of loan amount may be charged to your loan.

Loans offered in your state may be made by First Electronic Bank, a Utah-chartered industrial bank located in Salt Lake City, Utah. Personify works with First Electronic Bank to originate installment loans made by First Electronic Bank using the Personify Platform. Residents of this state can qualify for a Rate Reduction program. Those seeking a loan, and who are eligible for this program, will be provided more detail on the Offer Page.

Personify Financial installment loans for residents of South Carolina

We no longer offer any loan products in South Carolina. The material presented here is for informational purposes only.

.png?version=release-16014)